Omni-channel is no longer a buzzword. It’s been proven that businesses that provide omnichannel experiences are likely to see increased loyalty and higher average transaction value (ATV) across the board.

The ol’ single-channel

Back in the day, every business started with a single-channel. In fact, some businesses still are. Just picture an old family bakery down the street whose baked goods are so fresh and tasty the whole town knows about it. Sometimes word of mouth and years of quality are enough to keep a business running for more than one lifetime, even while everything else changes around them. Nowadays, very few businesses are truly single-channel. Taking orders and addressing clients by phone already turns an old bakery into a multi-channel business. Moreover, any enterprise looking to meet their client’s preferences will need to develop an online presence at some point. So what if the old bakery decided to build a website and engage with their audiences through this medium? Well, that’s 3 channels.

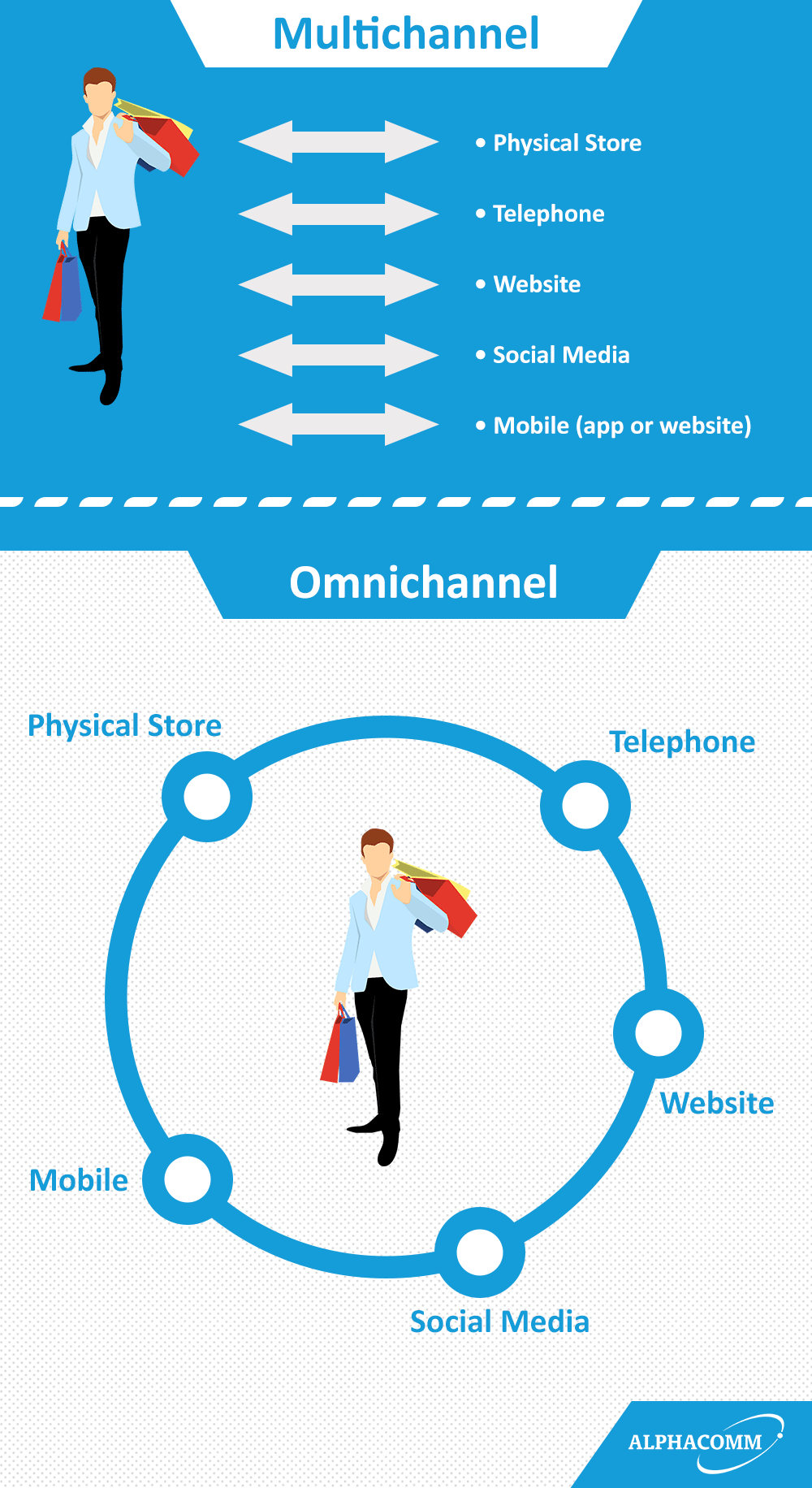

From multichannel to cross-channel

Multi-channel businesses offer various channels, but these channels aren’t integrated. For example, you might visit the website and chat with a representative, yet go to the physical store and come to the realisation that they have no idea what was discussed and zero knowledge regarding your online purchase history. On the other hand, cross-channel businesses have integrated their channels and are able to identify their customers regardless of the channel they use. For example, purchasing an item online and picking it up in a physical store. Or another example, purchasing a voucher offline in a store and redeeming it online on the company website.

So what is omnichannel exactly?

Now, this is where it gets interesting. Cross-channel and omnichannel are fairly similar. So similar in fact, that some experts even disregard term cross-channel altogether. However, the main differentiator is the goal of achieving total and complete ubiquity. It’s a goal that businesses never fully achieve since the possibilities for integration are always evolving and new devices or technologies will always push the goalpost just a tiny bit further.

You know what they did last summer

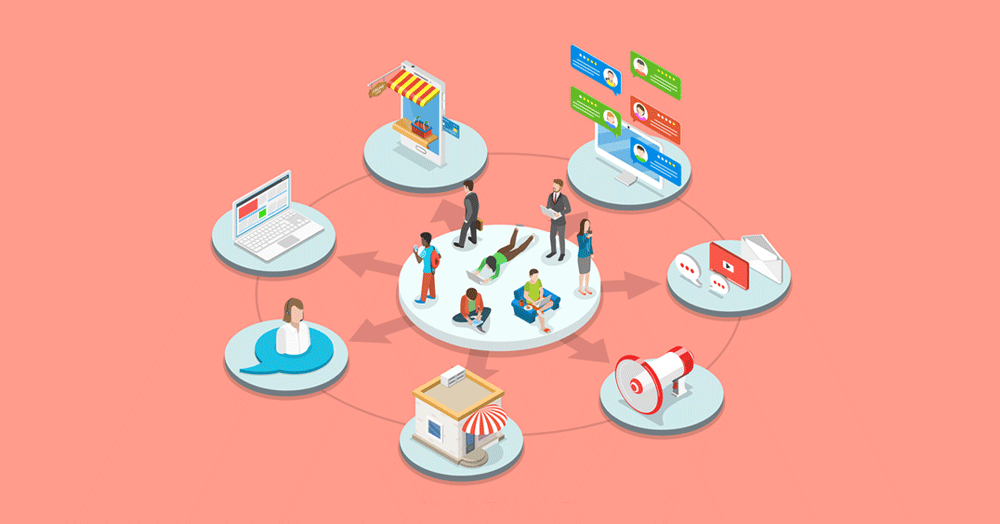

Omnichannel is all about allowing consumers to access your services in a seamless manner, no matter the channel. Through it all, their identity is always known and the experience is always the same. Your website, app, physical store and call centres are one and the same in the eye of the consumer. He moves seamlessly through all of your channels without ever feeling any sort of disconnect.

Omnichannel leads to ‘omnifraud’

Going down the rabbit-hole makes a lot of economic sense. For starters, omnichannel consumers spend more! Also, omnichannel consumers are loyal and their loyalty travels along with them when they are abroad. Being an omnichannel business also means offering secure payments across all devices and platforms. Needless to say, fighting fraud on multiple fronts is a huge challenge. According to a 2015 report by ACI and Forrester Consulting, consumer thirst for omnichannel experiences have left retailers with more questions than answers. The report found that 65% don’t think they have access to the right fraud management tools to operate in the omnichannel world. More than half stated that company staff didn’t have the necessary skills to tackle omnichannel fraud challenges while only 46% said they had fraud management solutions across all channels.

How to eliminate omnichannel fraud?

The more sales channels in use, the more possibilities for fraudsters. A one size fits all approach doesn’t cut it. The fraud challenges in CP and CNP environments are quite different, as are the technical differences between devices and platforms. Simply put, fighting fraud in an omnichannel environment requires omnichannel fraud management tools and the right team of experts to manage them.

Are you offering your clients a safe omnichannel experience? If you’re not sure, you might want to give us a call. At Mi-Pay, our goal is to secure revenue. To that end, we offer guaranteed payments and fraud consultancy services for the omnichannel environment. Get in touch with our team for more information on our business solutions.