Debt is prevalent in all European countries. Though the causes may differ, the types of debts are similar. Should businesses play a more proactive role in preventing and resolving consumer debt?

Europeans in arrears

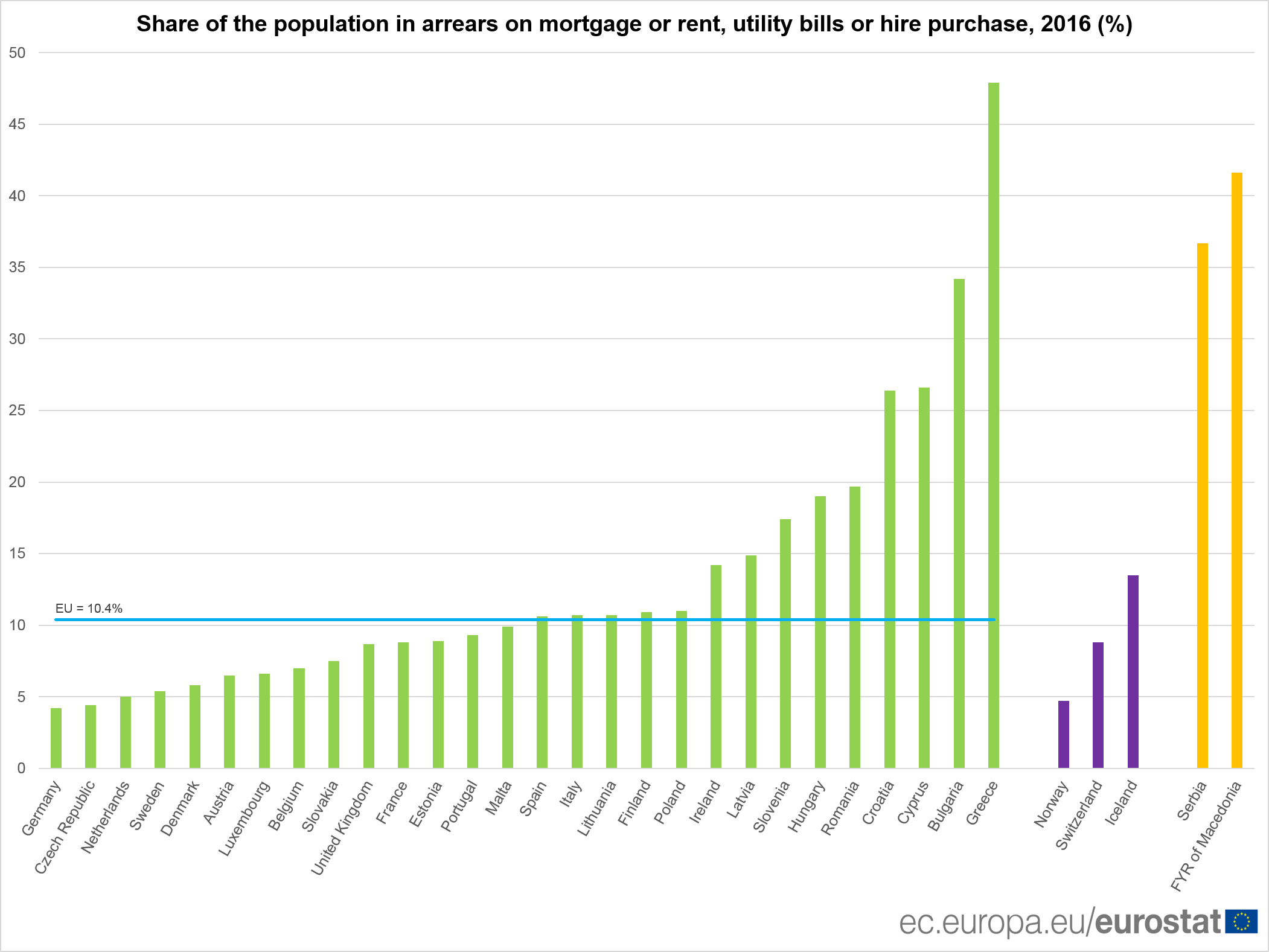

It is estimated that close to one in ten Europeans are in arrears with their rent, mortgage, utility bills or hire purchases. Within the European Union, the figure varies considerably. The problem is not limited to specific countries, nor are the causes. Whether it’s the cost of living, lack of employment, the burden of student loans or more personal reasons such as forgetfulness and poor financial planning, the issue of debt is complex and highly contextual.

The good news is that the number has been decreasing. EU-SILC survey figures published by Eurostat show that in 2017, 9.1% of European Union citizens were in arrears, compared to 12.5% in 2014.

Debts and delayed payments are the most common in Greece (44.9%), Bulgaria (33.3%), Cyprus (24.8%) and Croatia (21.4%). On the other hand, top performers within the European Union are Luxembourg (3%), the Czech Republic (3.2%), Germany (4.4%) and the Netherlands (4.6%).

Though the exact underlying reasons for debts may vary per country, the debt categories, e.g. utility bills, rent payments and hire purchases are represented across Europe.

Is there a role for business?

In a comprehensive study by Civic Consultancy, titled ‘Over-indebtedness of European households: updated mapping of the situation, nature and causes, effects and initiatives for alleviating its impact’ published in 2013, a number of sensible recommendations were made.

Among them, the need for lenders and service providers to be more proactive in contacting consumers in arrears and offering them options. The study also concluded that effective policy should aim to prevent and resolve indebtedness, rather than alleviate or manage it.

One way in which businesses can easily prevent customer debt is by improving their communication strategy. For starters, this means communicating through the channels that customers are most likely to respond to.

The need for better payment options

A sure-fire way to get paid faster, is by reducing friction in the payment process. Two key aspects to focus on are availability and accessibility.

In terms of availability, you should offer your customers the widest range of payment options possible. If you’re operating on an international scale, these payment options must include the regional and local methods your customers have come to trust and expect.

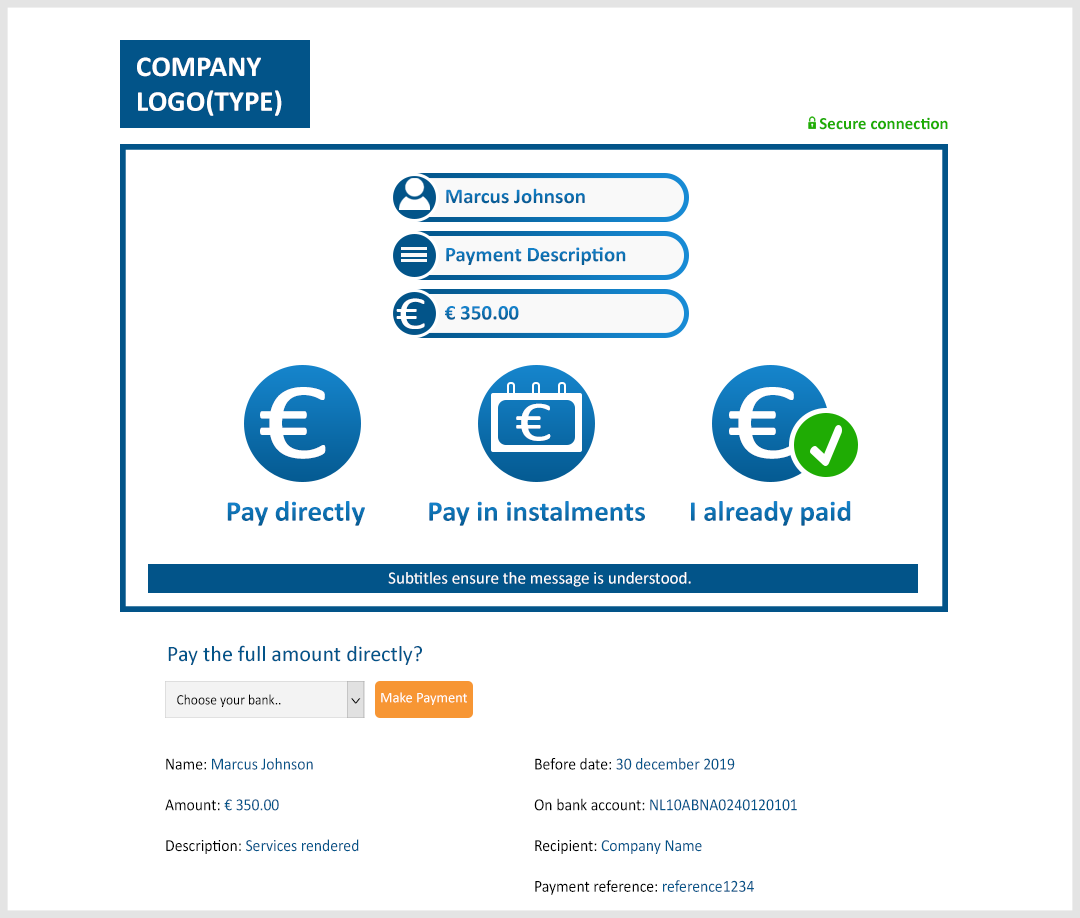

Moreover, the availability of payment methods should be complemented by ease of access. Customers should be able to pay their bills with a minimum amount of clicks. One way to achieve this is through direct paylinks. Upon receiving a paylink, customers are able to pay directly via their preferred payment method without needing to fill in any payment information.

Most businesses are still only sending letters, yet wonder why the response rate is so low. The truth is, customer preferences are changing. Whereas paying the bills used to be a desk activity, nowadays an increasing number of customers are making payments with their mobile devices, even when they’re on the go. This is a real opportunity for businesses aiming to get paid faster. To foster this trend, payment options need to be optimized for mobile devices.

Recommended reading: How automated payment reminders reduce DSO

The importance of better customer understanding

Organizations should also understand their customers on a more personal level. Some debts are not caused by financial reasons. Many end up in arrears as a result of low literacy. Complicated letters in legal jargon are easily misunderstood and oftentimes set aside. As a consequence, bills pile up and debts become unmanageable. With this in mind, we recently partnered with Dutch energy supplier Eneco and introduced interactive video reminders as the latest innovation in credit management.

The interactive video is an immersive audiovisual experience in which the customer is informed regarding the situation and then guided towards a solution. The videos include subtitles and can be paused as well as replayed at any time. As for the solutions, various payment options are provided. These include direct payment, payments in instalments and delayed payment. Customers who are unable to pay are provided with information regarding debt assistance. Similarly, customers who would like to dispute the charge can easily get in contact with a representative.

Recommended reading: Interactive video is the latest tool in the fight against late payments

Join the revolution

Thinking of joining forces with a financial technology firm? From challenger banks to payment platforms, Fintech firms like Mi-Pay are leading the way in terms of improving financial management for consumers. In Europe, Fintech is the largest investment category, totalling 20% of all global investments.

Feel free to get in touch with me if you’d like to learn more about the Mi-Pay payment reminder platform and what it can do for your business.

Michael Martens

Head of Sales